(JTA) – A group of Palestinian Americans is suing a government official in Florida over his decision to invest more than $700 million of county funds in Israel bonds — money that helps finance Israel’s military efforts as it battles Hamas in Gaza.

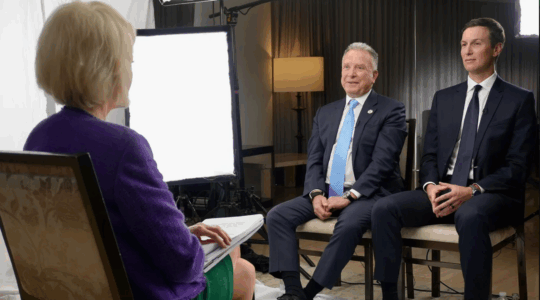

Joseph Abruzzo, who oversees investments for Palm Beach County, has put about 15% of the county’s funds into the bonds, making him the largest buyer of the debt in the world since Hamas attacked Israel on Oct. 7. His investments and outspoken support for Israel have earned Abruzzo praise from many in Palm Beach County’s sizable Jewish community.

The lawsuit accuses Abruzzo of violating state and county laws requiring officials to avoid risky investments and manage public funds without regard for ideological considerations. Abruzzo has disregarded financial warnings about the ability of Israel to pay back its debts and is motivated by his pro-Israel politics, the lawsuit claims.

Abruzzo rejects the claims in the lawsuit, arguing that investing in the bonds is not only legal but also beneficial in that they have delivered $172 million in interest payments to county coffers.

“We expect this frivolous case will be quickly dismissed,” he said in a written statement. “Palm Beach County has a strong, diversified portfolio designed to protect taxpayers’ investment.”

Filed in state court in Palm Beach County on May 15, the lawsuit comes two weeks after an article about Abruzzo’s investment spree in the Jewish Telegraphic Agency in which two experts on municipal finance noted that concentrating so much of taxpayer money in one type of investment is highly unusual and possibly risky. The lawsuit cites JTA’s reporting.

Traditionally sold to Jews in the Diaspora as a way to support Israel, the bonds can be purchased by any kind of investor and many financial institutions have become buyers in recent years. Abruzzo is one of many state and local officials who have been enthusiastically buying up the bonds in recent months while expressing support for Israel’s cause. Israel Bonds, the government entity issuing the debt, says it has sold more than $3 billion in bonds since Oct. 7, triple the normal annual amount.

But the trend is also driven by Israel bond yields that beat those of U.S. Treasury bonds and enabled by relatively recent laws in many states that allow local governments to buy Israeli debt while prohibiting other foreign investments.

The lawsuit was brought by three Palestinian-American residents of Palm Beach County. They filed anonymously and are asking the court to allow them to proceed without being named due to fear of harassment and reprisals against their family members in Gaza.

One of the plaintiffs says he has lost 37 family members due to fighting in Gaza. He has “suffered symptoms of PTSD, anxiety and depression knowing his county tax dollars are a significant contributor to the ongoing genocide in Gaza and endangering his family members,” the lawsuit says.

The American court system has become a focal point for advocates on both sides of the conflict hoping to advance their cause. Multiple universities, for example, have drawn lawsuits from pro-Israel and pro-Palestinian students over their handling of campus protests related to the war.

JTA has documented Jewish history in real-time for over a century. Keep our journalism strong by joining us in supporting independent, award-winning reporting.