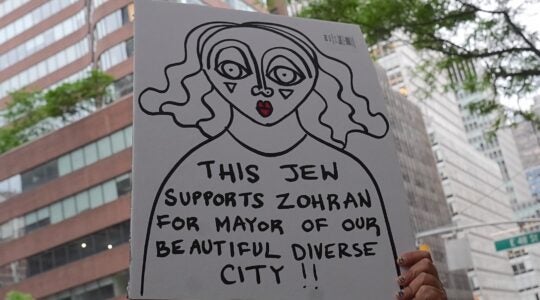

I read with alarm the wins and losses statistics in the “BDS: A Scorecard” in Israel Now, a Special Supplement to The Jewish Week (May 30). Taking the extremism of this movement most seriously, I was shocked to see that TIAA-CREF, the company I have invested a substantial portion of my retirement money in over the past 30 years, dropped Soda-Stream and Caterpillar from its Social Choice portfolio in 2013 due to BDS pressure.

I immediately went online seeking entries confirming or denying these claims. The first entry popped off the screen, “Victory! US pension fund giant TIAA-CREF drops SodaStream stock.” The press release was posted by the BDS organization, We Divest.org. I could not find any TIAA-CREF denials.

Subsequently I turned to my manager at TIAA-CREF, who said that the press release was false. I received a statement in writing from the company that Caterpillar was not dropped from their Social Choice funds as a result of BDS pressures, but due to other criteria, and both companies are eligible to be held by other TIAA-CREF funds. This was confirmed by the Los Angeles-based pro-Israel defense organization, www.StandWithUs.com.

So it seems that reportage emanating from both sides of the battle, from The Jewish Week and from anti-Israel BDS organizations, are inaccurate and confusing and require concerned individuals to dig deep and spend the time to investigate and combat anti-Israel propaganda and bigotry in order to promote the truth.

Manhattan

Editor’s Note: While we wrote, “TIAA-CREF dropped Caterpillar from its portfolio, but it is not clear how much of an effect BDS had on the decision,” we agree that we should have put that entry under “Unclear” instead of under “Losses.”

The New York Jewish Week brings you the stories behind the headlines, keeping you connected to Jewish life in New York. Help sustain the reporting you trust by donating today.