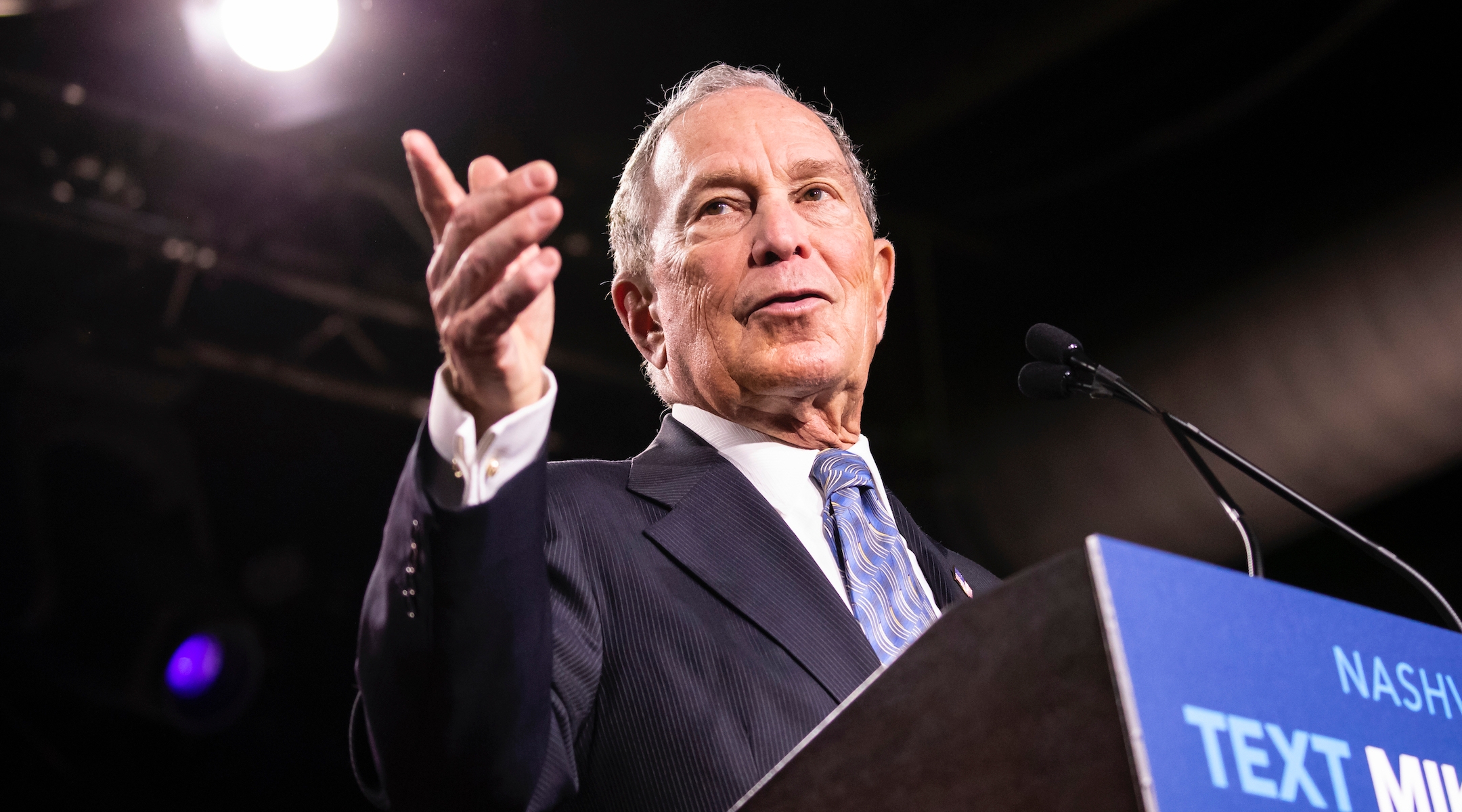

(JTA) — Mike Bloomberg, the billionaire businessman and former New York mayor, is vowing to catch whoever leaked his personal tax information to a team of investigative reporters.

The tax records, along with those of thousands of other wealthy Americans, were obtained by the nonprofit news outlet ProPublica and used in an expose on the U.S. tax system published Tuesday.

ProPublica produced a detailed account of how many of the richest people in the country pay little, and sometimes nothing, in income taxes because of how the tax law works. (No wrongdoing is alleged in the report.)

While the notion that the rich pay little in taxes relative to average wage earners has long been known or suspected, granular details on individual taxpayers is considered highly private and only rarely comes to light. The tax returns of former President Donald Trump were a matter of intense public interest and eventually were obtained, at least in part, by The New York Times last year.

The hard data, ProPublica wrote, “demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most.”

Bloomberg, a prominent Jewish philanthropist and the 13th-richest American, according to Forbes, features prominently in the article.

He reportedly paid $70.7 million on income of $1.9 billion in 2018, which amounts to a 3.7% tax rate. The median American household typically pays about 14% in federal income tax. Bloomberg benefited from Trump-era tax cuts, write-offs on charitable donations and credits for having paid foreign taxes, according to ProPublica.

The tax data also showed that between 2014 and 2018, Bloomberg’s wealth increased by $22.5 billion while his tax burden for that period was $292 million, or 1.3%.

The disparity points to a fundamental feature of the U.S. tax code. Income from wages or the sale of stocks is taxed. An increase in the value of an asset is not considered income and therefore is not taxed.

In a statement, a spokesperson said Bloomberg would act to discover who was responsible for the unauthorized release of his private financial records.

“We intend to use all legal means at our disposal to determine which individual or government entity leaked these and ensure that they are held responsible,” the statement said.

Bloomberg’s statement also said that the leak is a violation of his privacy.

“The release of a private citizen’s tax returns should raise real privacy concerns regardless of political affiliation or views on tax policy,” the statement said. “In the United States no private citizen should fear the illegal release of their taxes.”

The statement also defended Bloomberg’s record by noting his support for tax hikes on the rich during his presidential campaign, and his generous philanthropic giving — $11 billion in his lifetime. When Bloomberg won the $1 million Genesis Prize, which recognizes dedication to the Jewish community, for example, he gave away the money, mostly to Israel-related causes.

“Taken together, what Mike gives to charity and pays in taxes amounts to approximately 75% of his annual income,” the statement said.

Among the other billionaires examined in the expose are two other Jews, George Soros and Carl Icahn, as well as Elon Musk, Jeff Bezos and Warren Buffett.

Soros, an investor who has contributed billions to charity, especially liberal causes, responded by saying he supports tax hikes on the wealthy.

“Between 2016 and 2018 George Soros lost money on his investments, therefore he did not owe federal income taxes in those years,” a spokesperson said in a statement. “Mr. Soros has long supported higher taxes for wealthy Americans.”

Icahn, meanwhile, took a different tack. The businessman, who is ranked as the 40th-richest American by Forbes, criticized ProPublica for its line of questioning.

In an interview, he was asked “whether it was appropriate that he had paid no income tax in certain years.”

In response, Icahn said: “There’s a reason it’s called income tax. The reason is if, if you’re a poor person, a rich person, if you are Apple — if you have no income, you don’t pay taxes.” He added: “Do you think a rich person should pay taxes no matter what? I don’t think it’s germane. How can you ask me that question?”

JTA has documented Jewish history in real-time for over a century. Keep our journalism strong by joining us in supporting independent, award-winning reporting.